Happier and healthier employees with ZavFit

We can make a difference to your organisation right now. As a HealthTech company, at the heart of MoneyFitness is our ZavFit app. Here’s how we can help.

Money stress. It has a devastating impact on your business and your employees. 6 in 10 employees say that worrying about money is the biggest cause of their stress. And it’s the cause of half of working days lost. Shocking, isn’t it?

For many, money is not just a financial problem, it’s a chronic daily stress that leads to absenteeism, lower productivity and higher staff turnover. In the UK alone, mental health costs businesses more than £40bn a year, with the average cost per employee a staggering £1,560.

But it doesn’t have to be this way.

We know every organisation - and individual - is different. That’s why we make financial wellbeing about the individual and their health and wellbeing. It’s never been more important to help people feel better.

Are you ready to make a difference to your employees, customers or members?

We can make a difference to your organisation right now. As a HealthTech company, at the heart of MoneyFitness is our ZavFit app. Here’s how we can help.

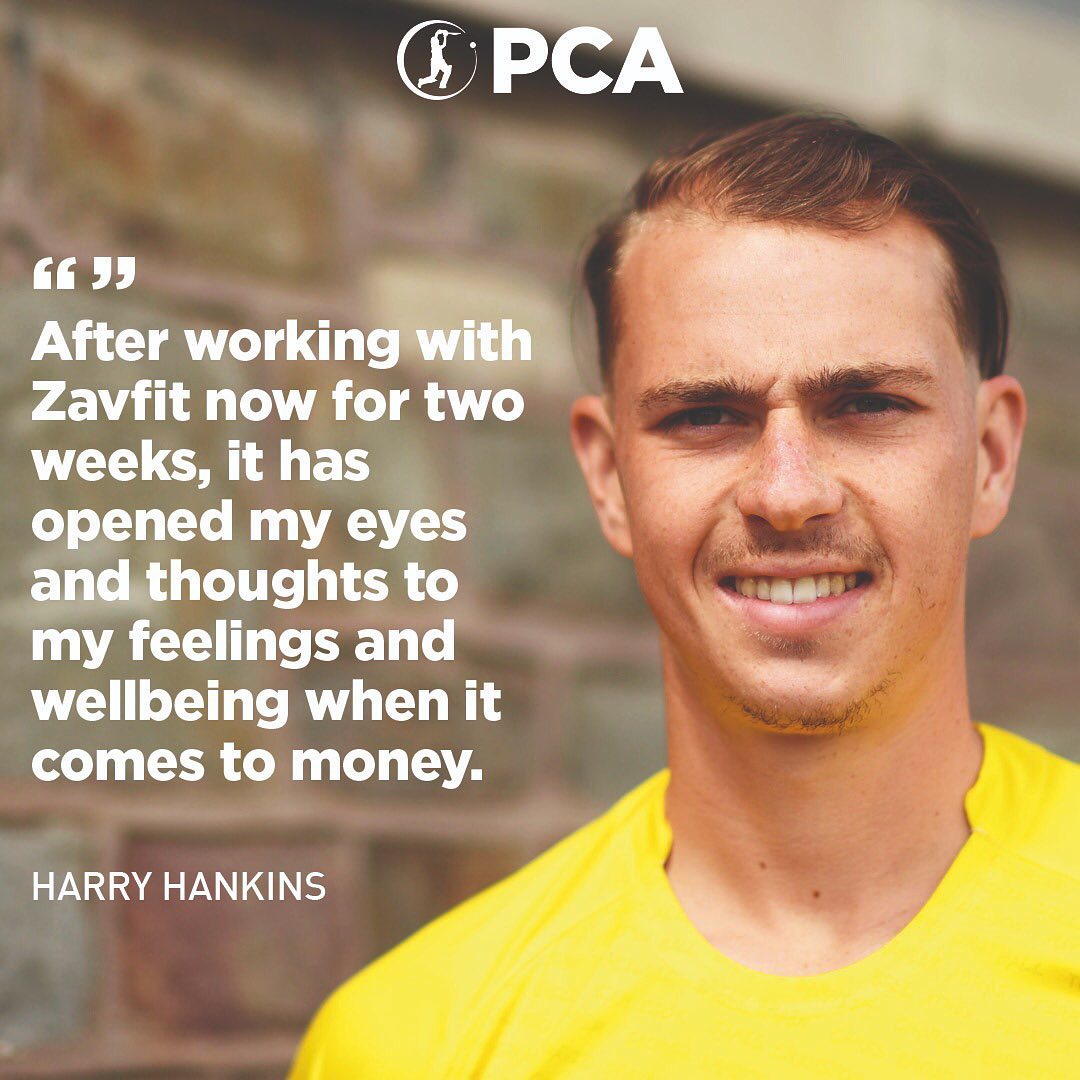

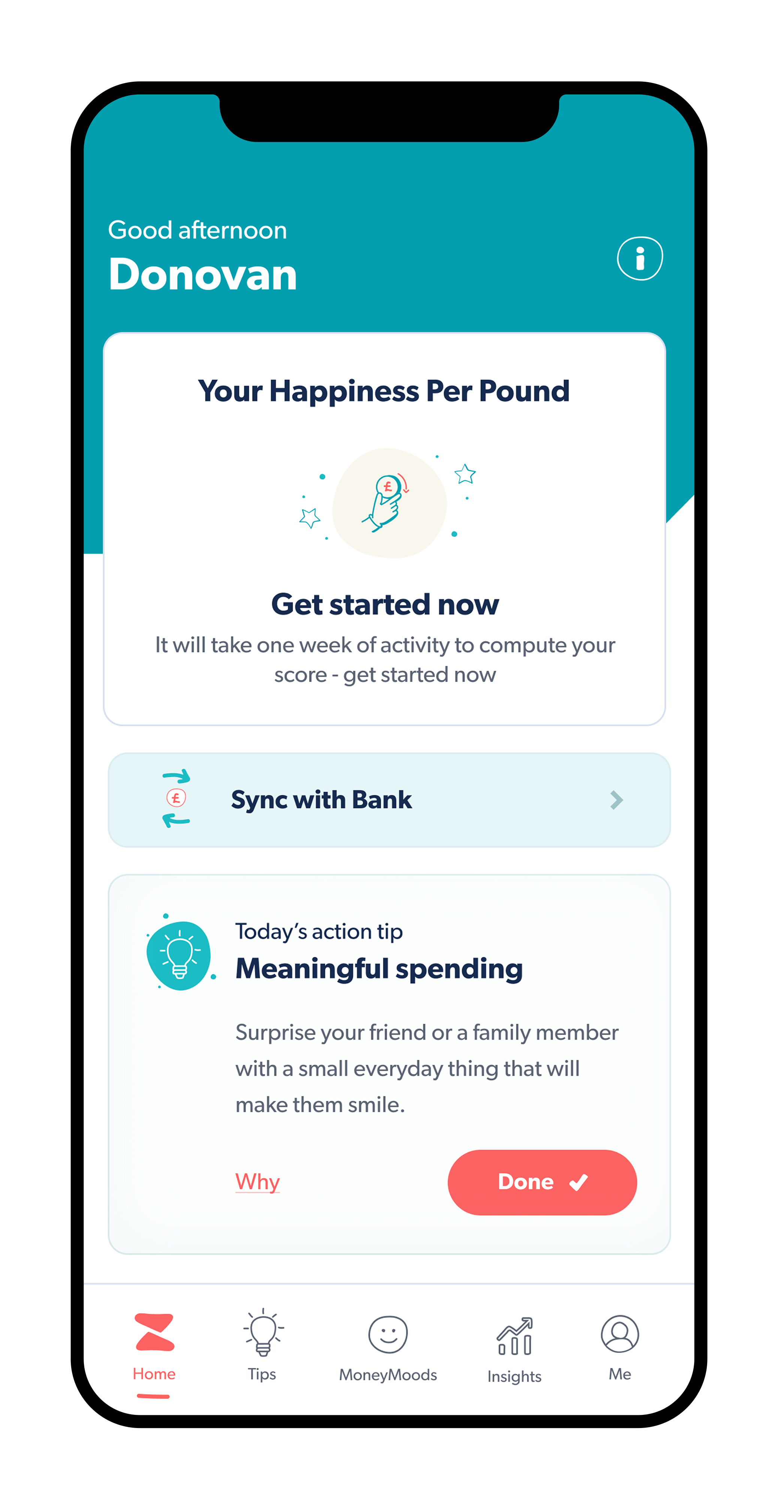

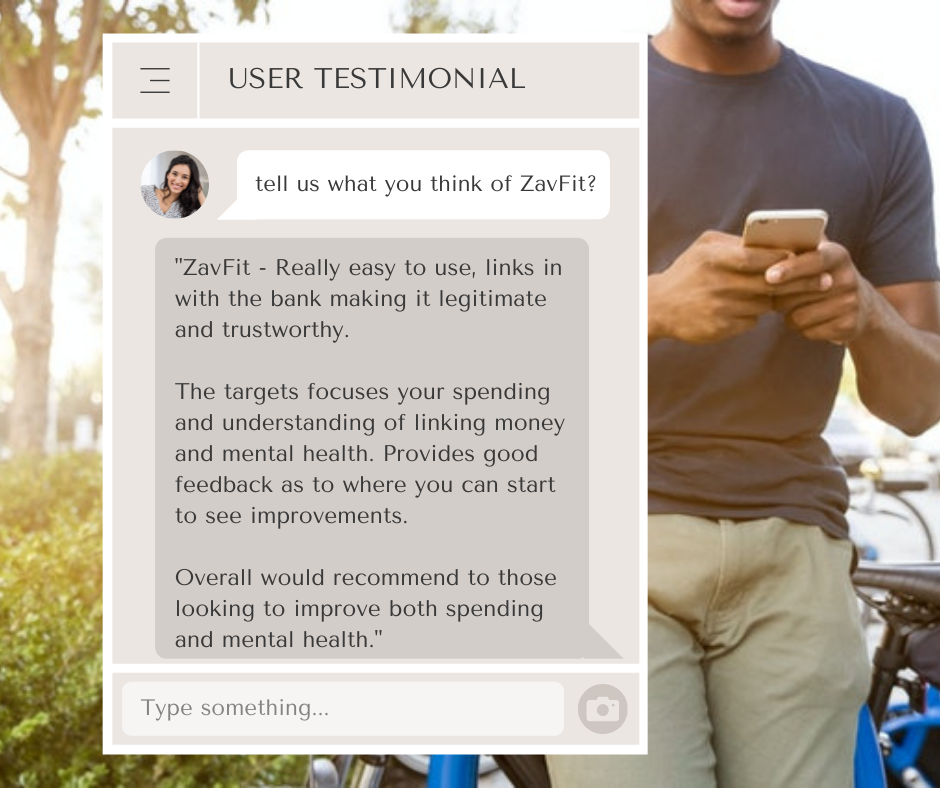

In our app we tackle money stress as a health issue using preventative techniques that are proven successful in the fitness and health industries. We do this by bringing wellbeing and money together in an entirely unexpected and personalised way. The ZavFit psychology engine creates personalised targets that suggest positive ways to use your money to feel happier and healthier.

Join our community using the ZavFit app and schedule a demo today.

Financial wellbeing education is a critical aspect of any corporate wellbeing strategy. With half of UK adults rating their anxiety as high, and finances the biggest overall worry across the board, our proven MoneyFitness education programme helps people to think differently and approach money in a healthy way.

Created around four Challenges that build knowledge and skills week by week, the programme directly tackles the habits, mindset and emotions that give rise to money stress.

At the end of the programme, your employees will feel happier, less stressed and more focused. Request a brochure.

Mental Health is at last receiving the attention it deserves. World Mental Health Day, Stress Awareness Month and Global Wellness Day, amongst many others, are now major events in the international calendar.

Our free awareness campaigns are the perfect way to get your employees, customers or members thinking differently about their health and start to recognise that money stress is negatively impacting their overall wellbeing and health.

We offer ready-to-go multi-media content for your organisation’s employee communications and social media channels. Request details about our MoneyFitness campaigns.

GSA, Global Student Accommodation, ran the ZavFit wellbeing programme for their UK student residents in Q1 2020. Bobbi Hartshorne, Head of External Relations and Student Wellbeing, GSA, says:

"Wellbeing is core to our student experience at GSA, with the health and happiness of our student residents a top priority. We’ve been proud to partner with ZavFit on their MoneyFitness programme, especially as ‘financial wellbeing’ is one of the core pillars of our student wellbeing framework and this partnership has allowed us to engage with and support students in a much richer and more impactful way. ZavFit has an innovative take on Financial Wellbeing and a practical approach focused on delivering tangible outcomes."

We’d love you to join our community.